What could interrupt the weaker US dollar trend?

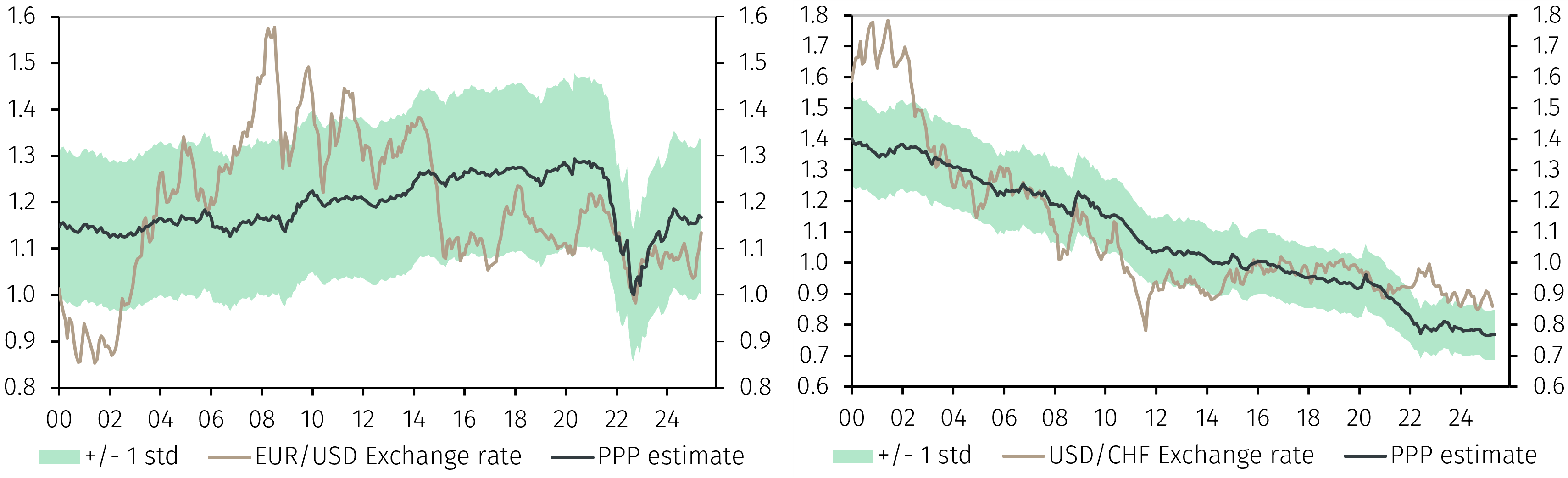

In the short term, any steps taken by the US administration that help restore credibility, trust and predictability would likely support the dollar. If the underlying problem is market scepticism about the effectiveness and necessity of trade tariffs, any actions that calm this caution could be well received by markets. An announcement, perhaps in the next few days, that reduces market concerns about the economic repercussions could help stabilise the currency market. In the absence of such an announcement, it cannot be ruled out that the EURUSD exchange rate will rise towards 1.20 and the USDCHF exchange rate will fall towards 0.75. News over the weekend that mobile phones and laptops will be excluded from tariffs for the time being represent a step in the right direction.

Separately, some central banks, notably the European Central Bank and the Swiss National Bank (SNB), will be concerned both with the speed of the move in the dollar and also the extent of the decline. This may encourage both central banks to adopt a more dovish policy stance, which in the case of the SNB will likely include currency market interventions, to offset the disinflationary impact of a strong euro and Swiss franc.

The medium-term implications of the recent developments point to a reduced role for the US dollar within the international financial system, including a smaller share in central bank foreign currency reserves. However, this will play out over years as there is currently no credible alternative that could replace the dollar.

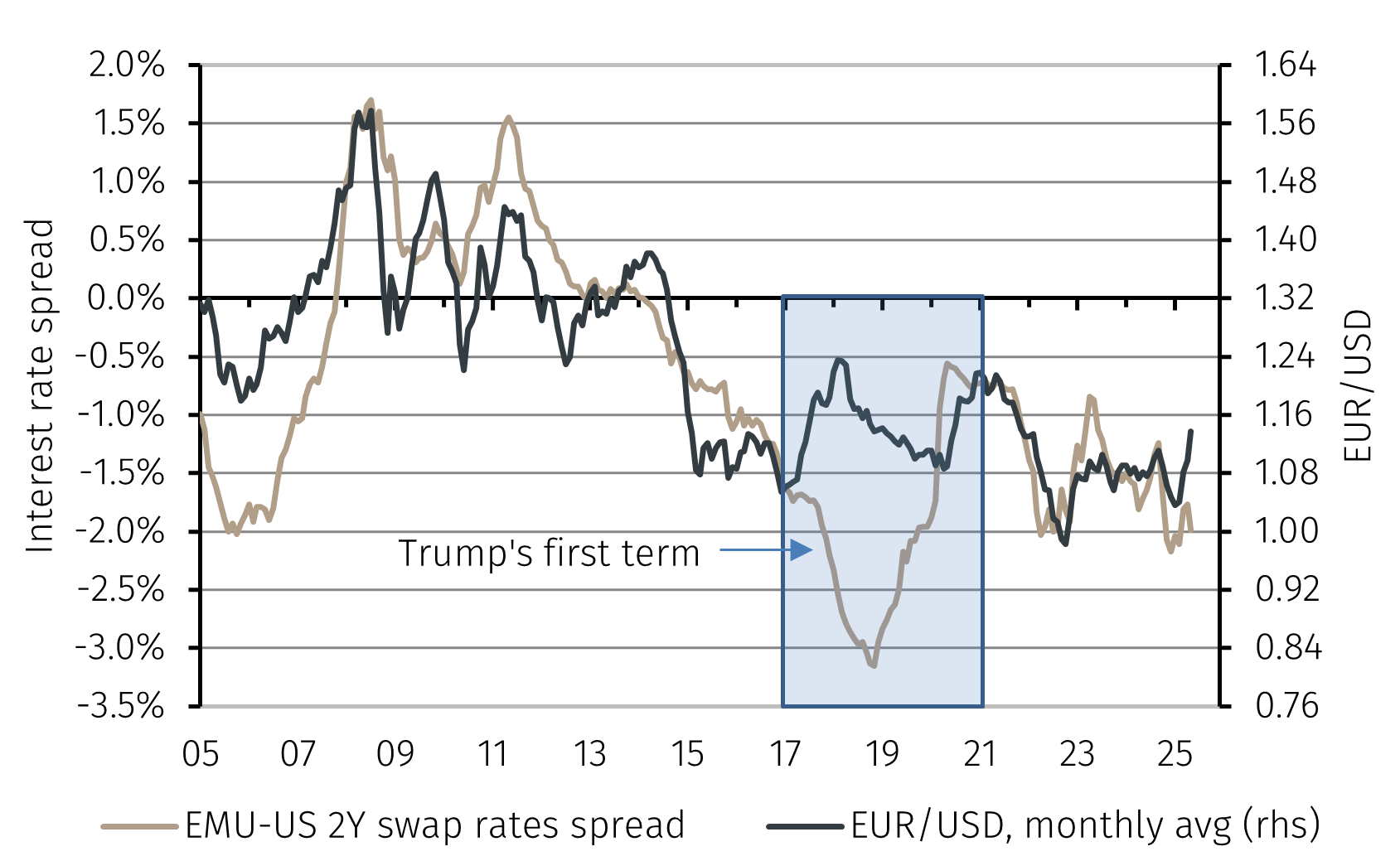

Our expectation is that following this period of adjustment and volatility, US dollar bilateral exchange rates will continue to be strongly influenced by business cycle fundamentals, including GDP growth, inflation, interest rates and the state of public finances. Ultimately, it will be the economic policies adopted by governments around the world in response to the Trump administration’s actions that will determine the medium-term trends on the currency market.