At its meeting on 06 November, the Bank of England (BoE) Monetary Policy Committee (MPC) left its policy rate, Bank Rate, unchanged at 4%. This was significant in that it broke the cycle of rate cuts at every other meeting, which had persisted since August 2024. Five members of the MPC voted in favour of the decision, marginally edging out the four members who preferred to cut Bank Rate by 25 basis points to 3.75%.

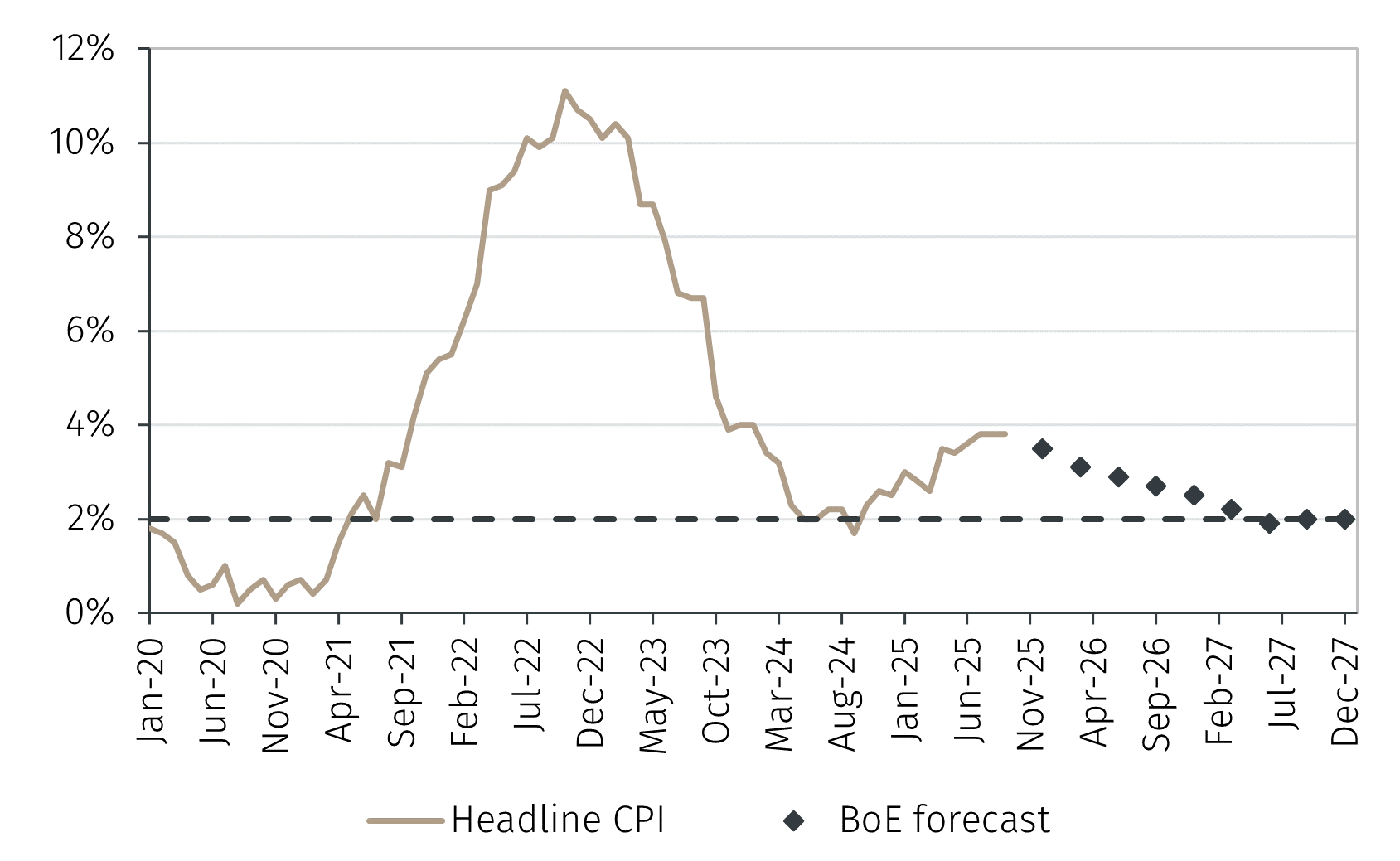

A gradual decline in inflation expected

The Bank believes inflation peaked at 3.8% year-on-year in September and will gradually decline from its current level. However, the updated set of baseline forecasts released in November’s Monetary Policy Report highlight that the decline in inflation is expected to be gradual. Indeed, the Bank does not project inflation to fall back to the 2% target until 2027 (see Chart 1).