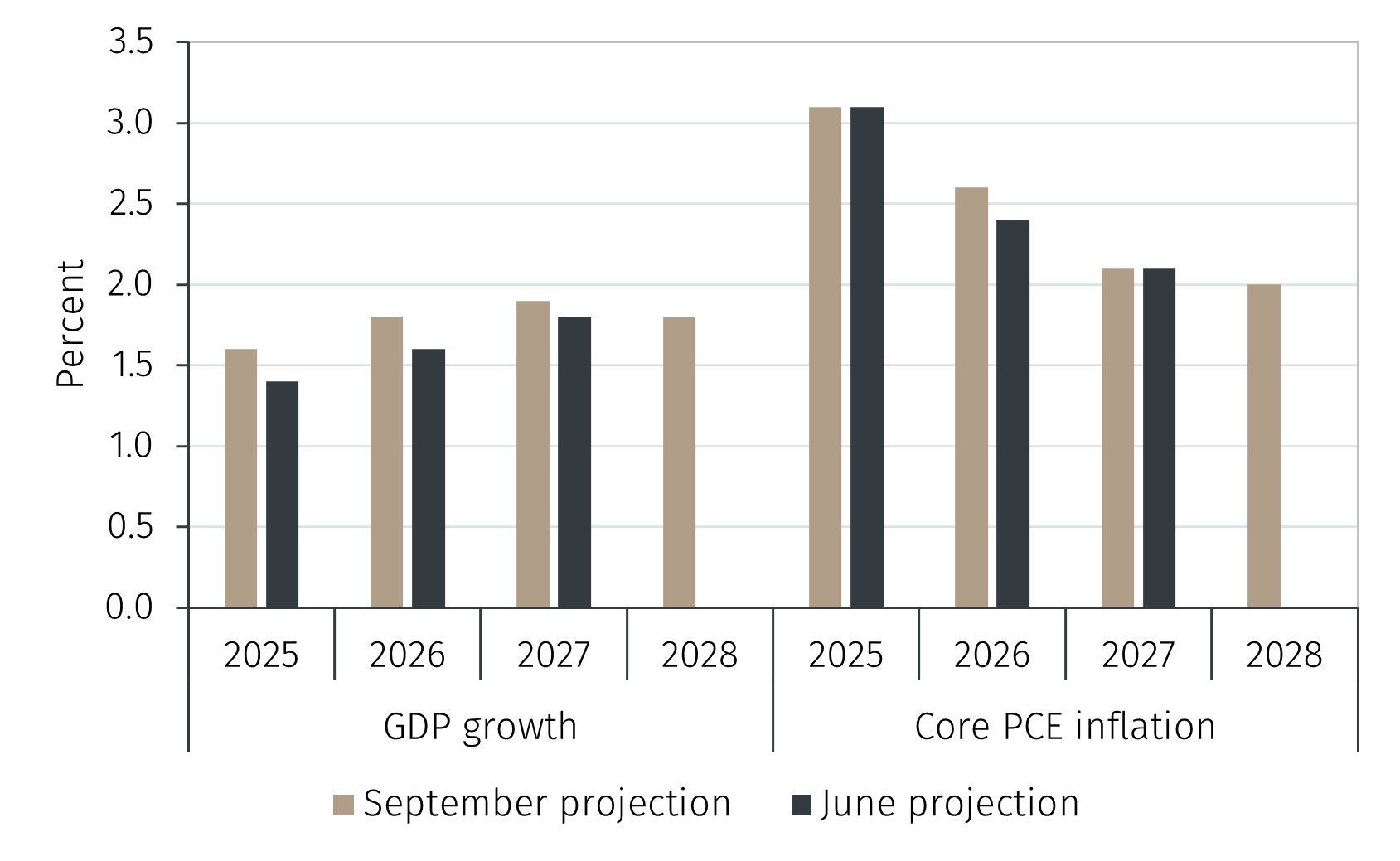

This uncertainty was reflected in a degree of inconsistency in the Fed’s messaging, with growth expectations revised higher for this year and next while inflation expectations at both the headline and core levels were unchanged for this year but revised higher for 2026 (see Chart 1). In fact, the Fed does not see core inflation coming back to target until 2028 at the earliest.

What Pythagoras’ theorem can teach us about the Fed

Investment Insights • Macro

2 min read

Fed's September rate cut: a balancing act amid uncertainty

Sometimes it is better to travel than to arrive and so there was a risk that, following a good summer, markets would take a step backwards after the Fed’s eagerly anticipated rate cut at its meeting on 17 September. In the event, the main US equity indices finished the session little changed, breathing a sigh of relief that the median Federal Open Market Committee (FOMC) member signalled ongoing rate cuts at each of the meetings into year-end but also cognisant that future policy decisions will likely be finely balanced.

Chart 1. Median FOMC member’s inflation and GDP growth projection

Source: Federal Reserve. Data as at 17 September 2025.

That robust growth and inflation outlook explains why seven FOMC members do not foresee any more rate cuts this year, painting a slightly different complexion on the headline news.

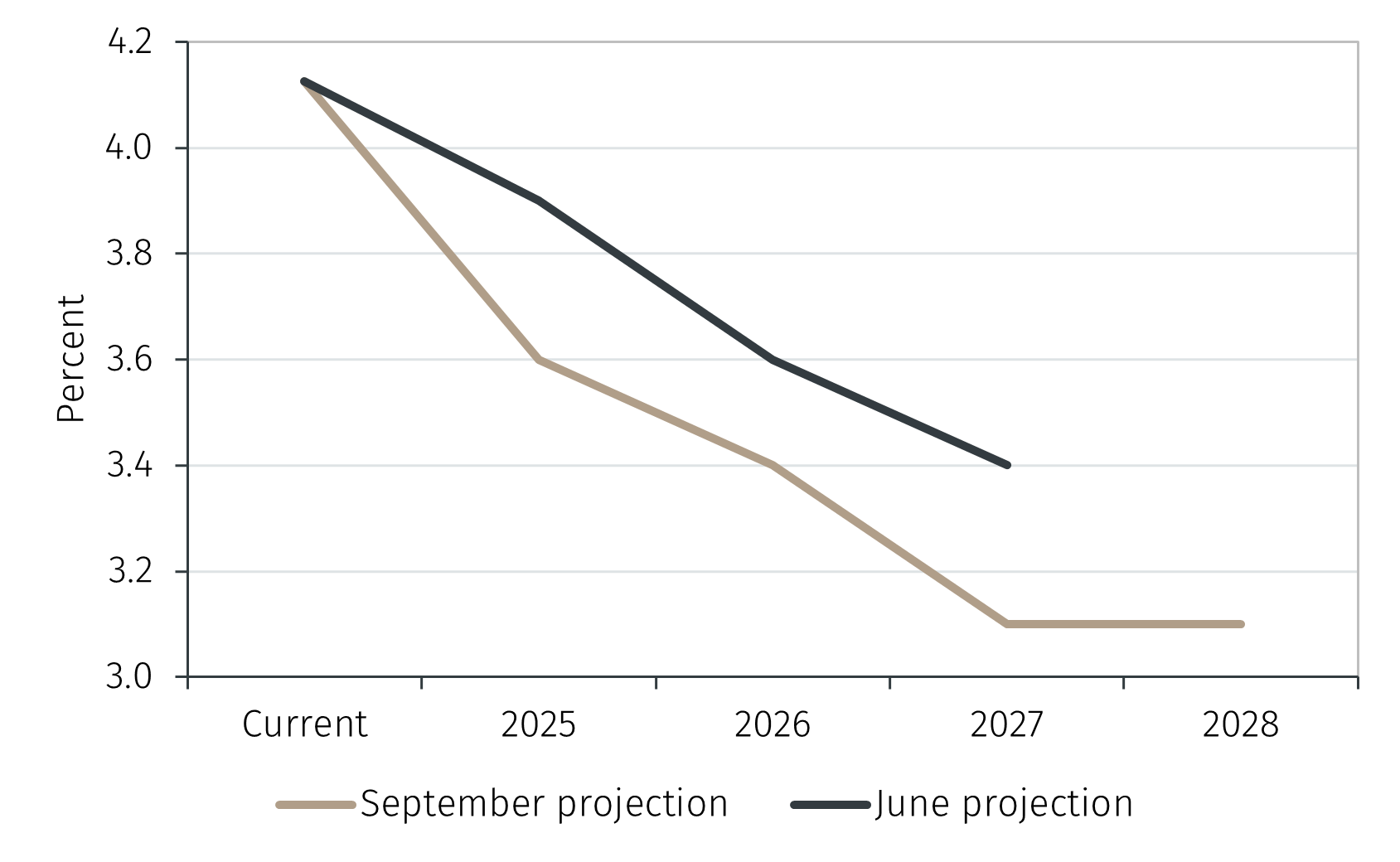

Chair Powell acknowledged a shift in the balance of risks facing the labour market and this is the reason why the Fed chose to ease policy at this meeting. The median FOMC member now sees a rate cut in each of the remaining meetings this year (see Chart 2). However, Powell also said that future decisions will be taken on a “meeting-by-meeting” basis. As we have seen this year, rate expectations can and do shift very quickly, contingent on incoming data.

Chart 2. Median FOMC member’s federal funds rate projection

Source: Federal Reserve. Data as at 17 September 2025.

The ideal situation would be one in which the labour market remains steady, inflation trends gently lower and the economy continues to expand at a decent but not overly rapid pace. That does not seem like an unreasonable outlook at the moment. However, a degree of complacency has set in regarding the impact of tariffs, which has so far been muted but which may simply have been delayed. The fourth quarter will be critical for making that assessment.