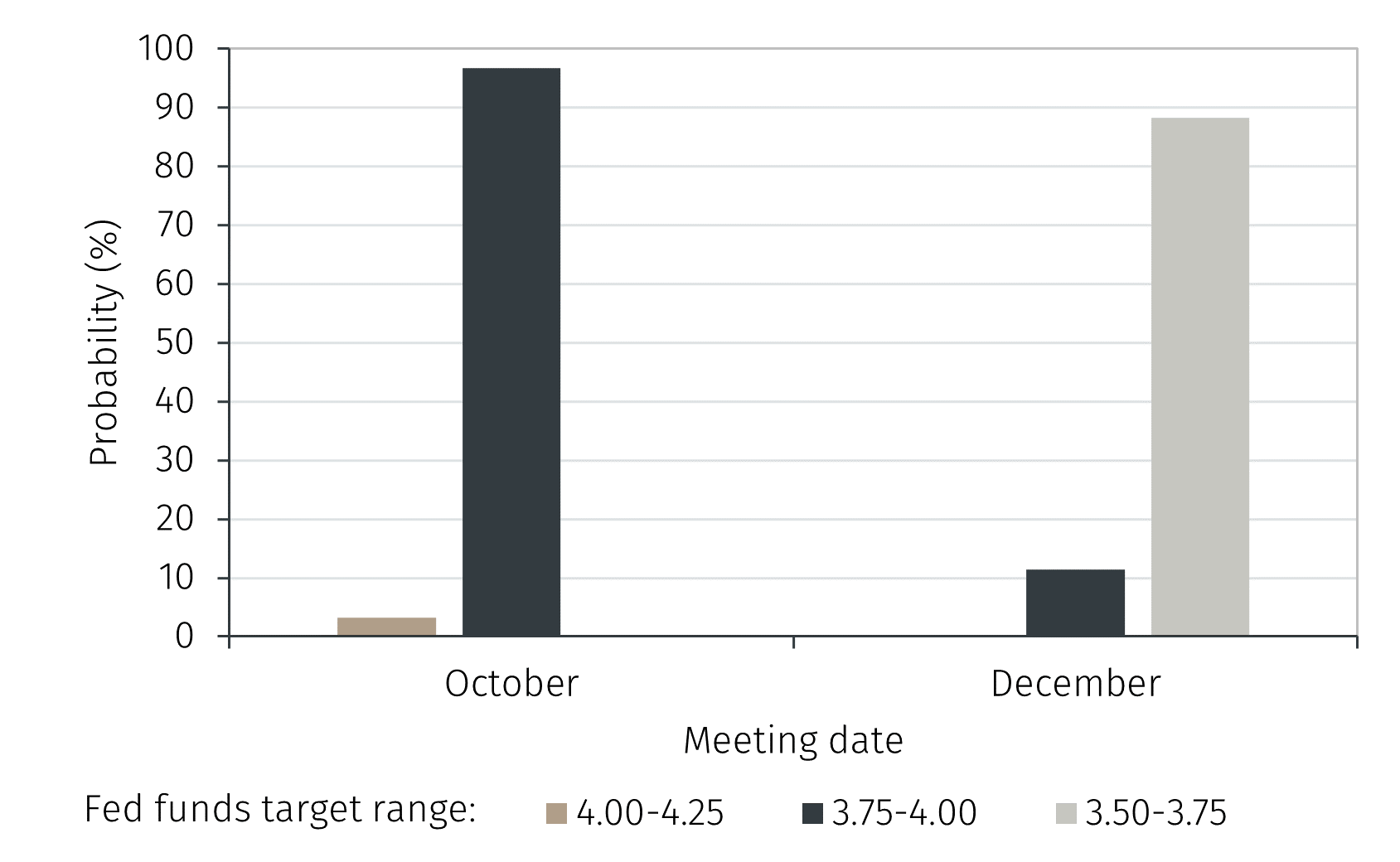

At its meeting in September, the Federal Open Market Committee (FOMC) agreed to reduce the Fed funds target range by 25 basis points to 4.00-4.25%. The decision reflected FOMC members’ views that the balance of risks facing the labour market had shifted and required a less restrictive monetary policy.

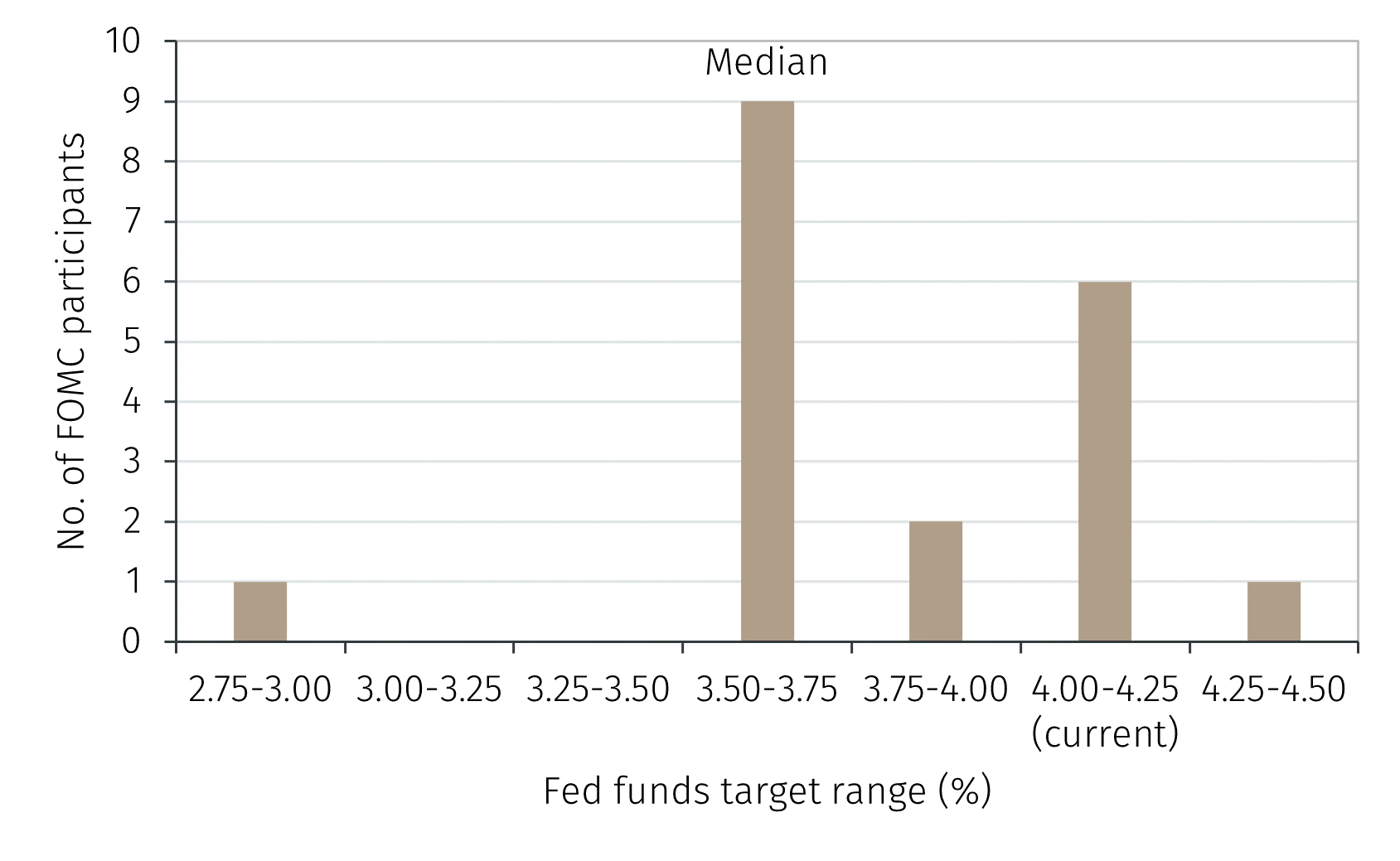

Furthermore, the ‘Summary of Economic Projections’ document signalled that the median FOMC member expects a rate cut at each of the two remaining meetings in 2025 (see Chart 1). However, looking only at the median FOMC member’s rate expectations misses the asymmetry of the distribution of expectations, which shows that there is a significant risk of a less dovish path for the Fed funds target range.