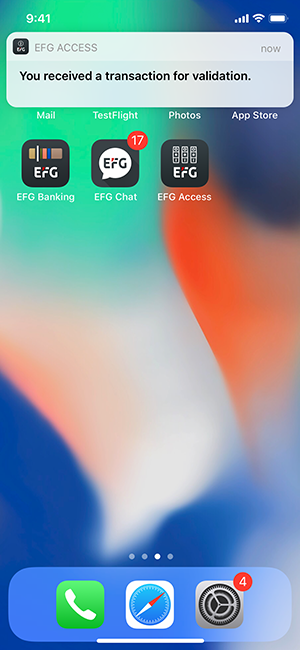

Introducing the EFG Access app

The EFG Access mobile app can now be used to verify requests from your eBanking accounts, quickly and securely, enabling actions to be executed. The request can be to confirm external payments, provide double signatures and authenticate client identity.

Eligible users

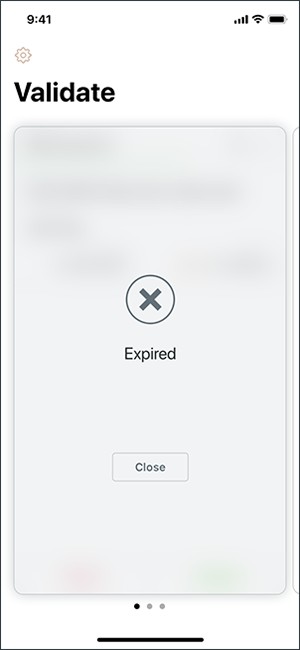

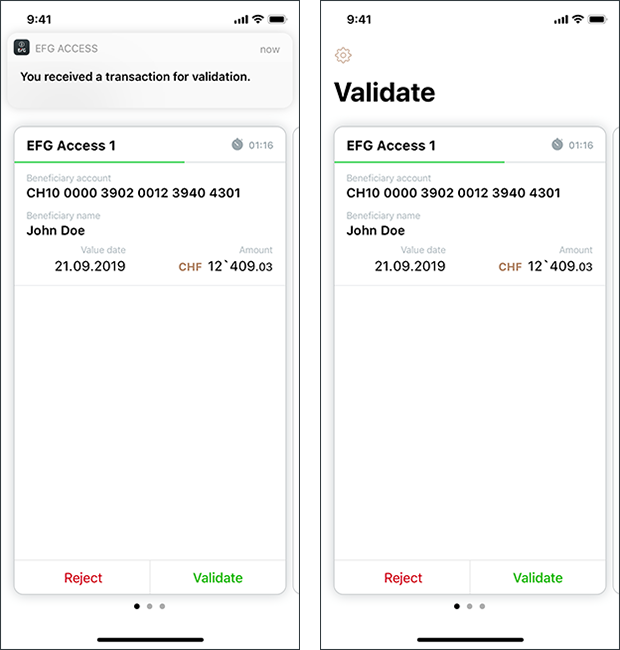

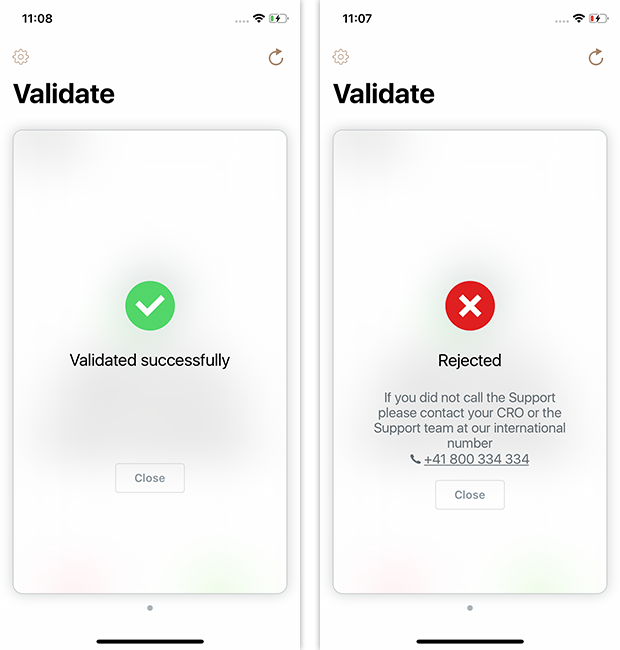

Validation of payments

EFG Access is designed for EFG clients with European and Asian accounts. The application is fully compliant with European directive PSD2 and meets the strict client-authentication requirements that were implemented on 14 September 2019.

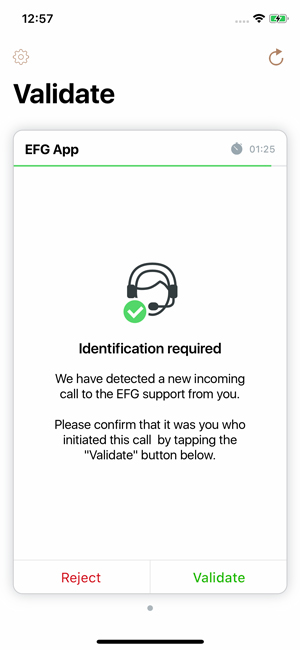

Support identification

EFG Access can be used by all clients calling our support line to verify their identity when they call our eBanking support team.