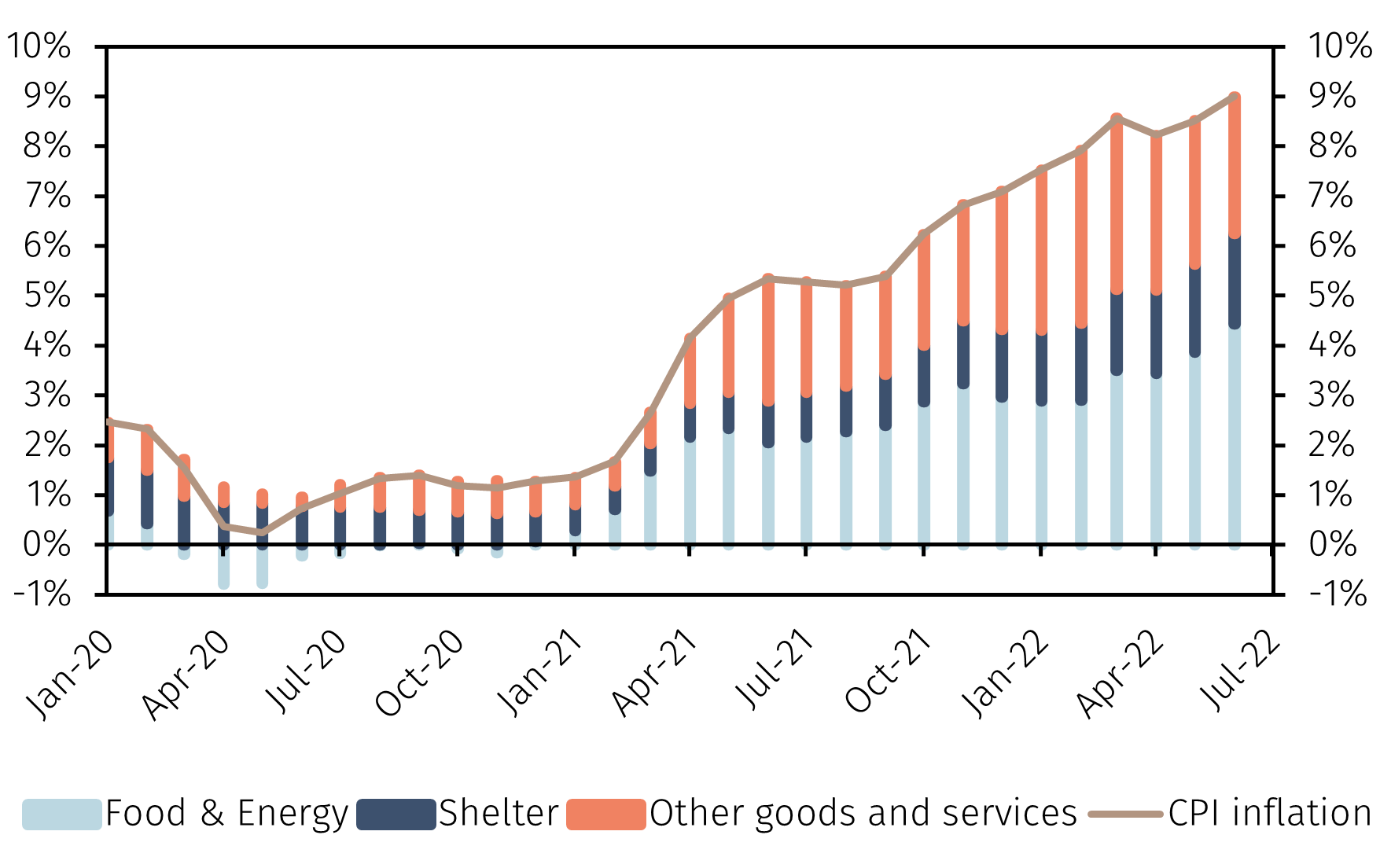

In June, US inflation was the highest in over forty years at 9.1% year-on-year (yoy). Energy and food prices explain half of overall inflation despite accounting for only one fifth of the CPI basket. Moreover, price increases are increasingly widespread as shown by rising core and median inflation. There is concern that high inflation will become entrenched in private sector expectations and that the Fed will have to raise interest rates aggressively in response, thereby causing a recession.

Investment Insights

4 min read

Is this the peak for US inflation?

In June, US inflation reached its highest level in four decades. Many observers fear that this means the Federal Reserve will have to continue raising rates aggressively and that this will push the economy into recession. However, in this Macro Flash Note GianLuigi Mandruzzato notes that several factors point to an upcoming drop in inflation that could allow the Fed to take a more gradual approach after the summer.

Chart 1. Contributions to US CPI inflation (yoy)

Source: Refinitiv and EFGAM calculations. Data as at 14 July 2022.

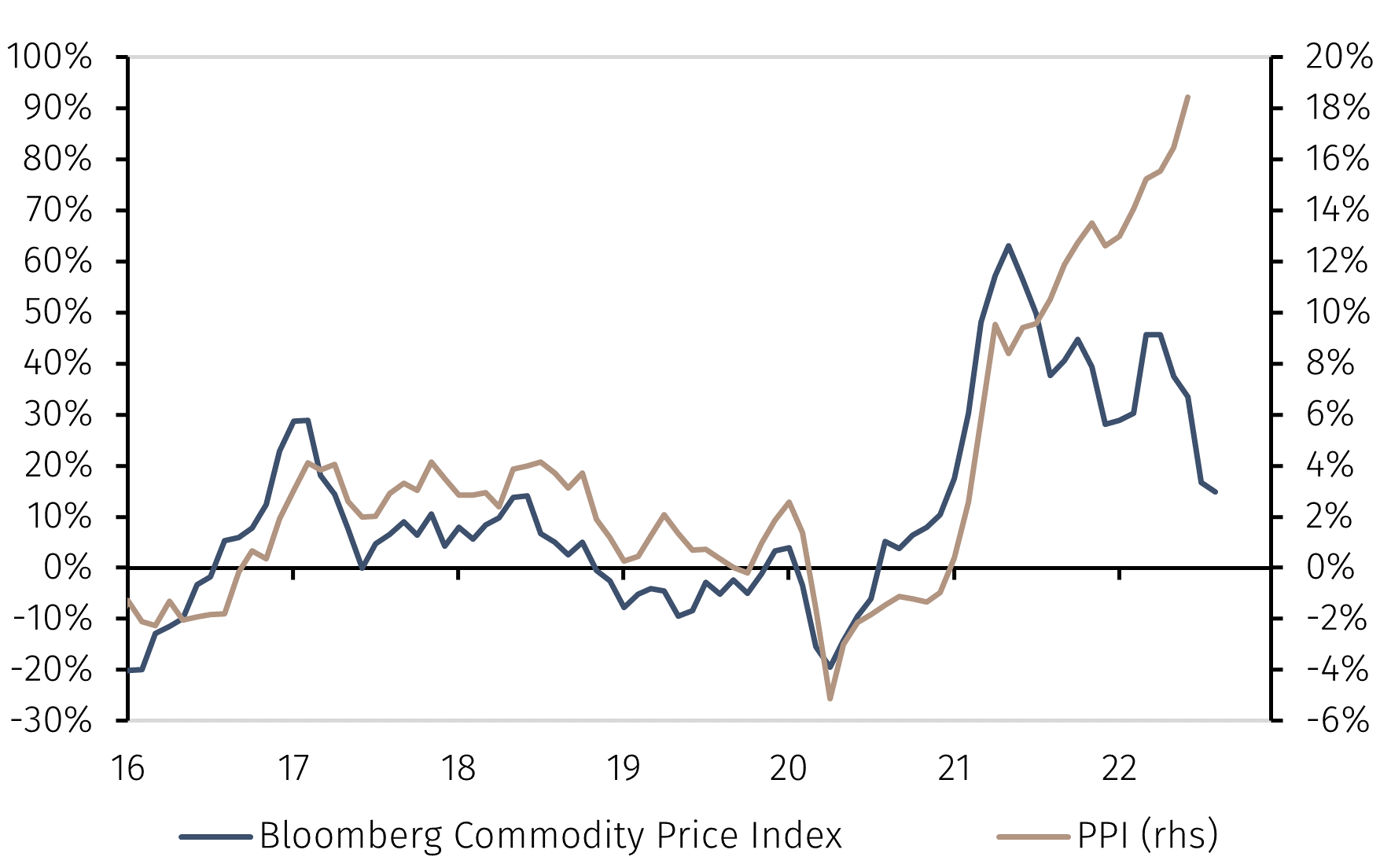

However, it should be noted that several elements suggest the wind has changed and inflation will fall in the remainder of 2022 and in 2023, converging towards the Federal Reserve's target. First, oil and gasoline prices have fallen by about 25% since early June, something not captured in last month’s CPI. The price of natural gas has also fallen, suggesting that the price of electricity and heating will soon moderate. In addition, the prices of agricultural commodities and industrial metals have also decreased by 20% and 40% respectively from their recent peaks.

Chart 2. Commodity prices and US PPI inflation (yoy)

Source: Refinitiv and EFGAM calculations. Data as at 14 July 2022.

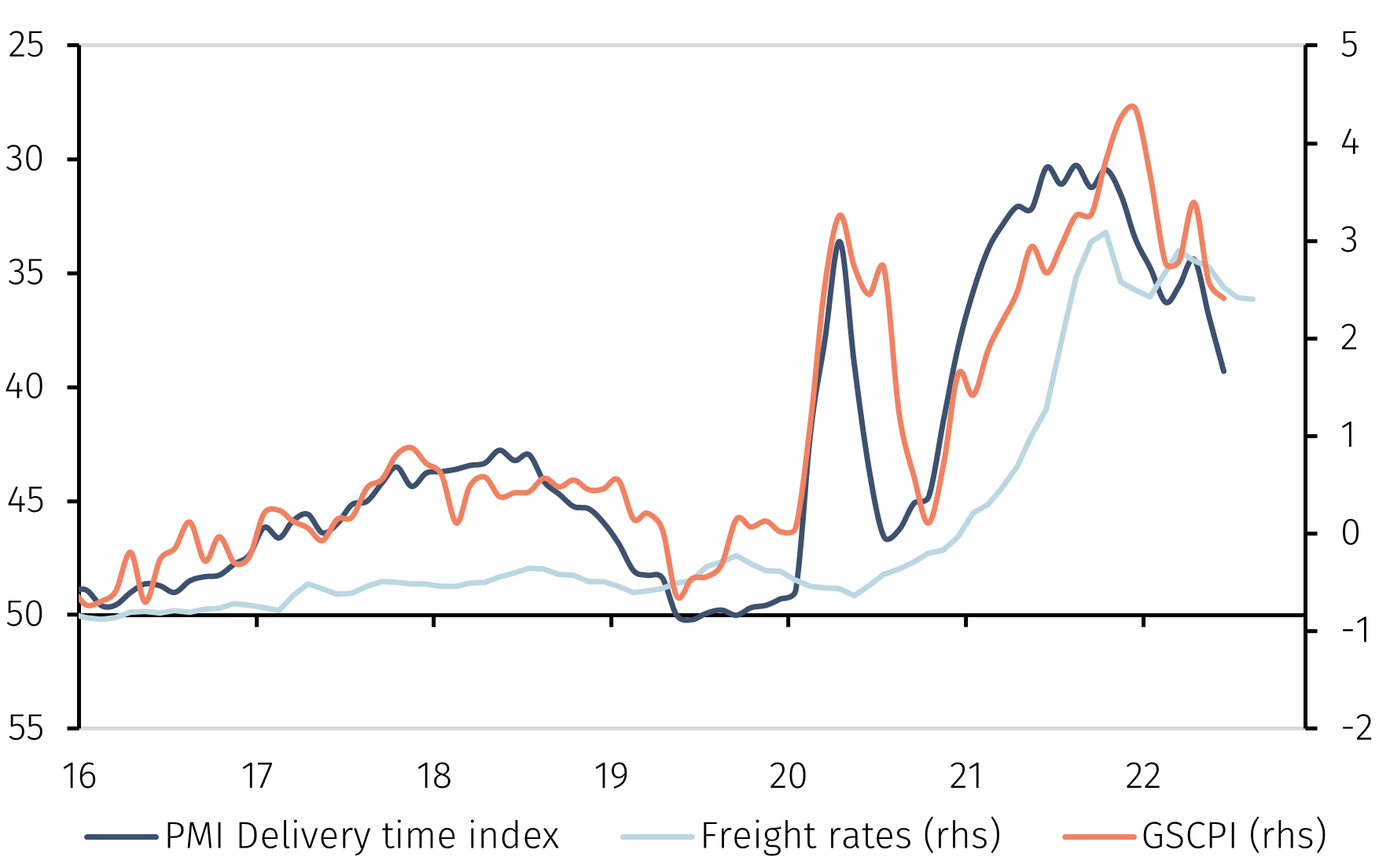

The second factor to consider is the drop in freight rates and the easing of global supply chain bottlenecks. The Baltic dry index is now about 40% below the levels of a year ago and about two thirds lower than last October’s peak. Air freight rates have also fallen significantly since December. In addition, the normalisation of delivery times of manufactured goods continues, as shown in the PMI surveys and in shortened waiting times at Chinese ports. The easing of supply chain bottlenecks and lower transportation costs favour a moderation of retail prices.

Chart 3. New York Fed Global Supply Chain Pressure Index (GSCPI) and its drivers

Source: Refinitiv and EFGAM calculations. Data as at 14 July 2022.

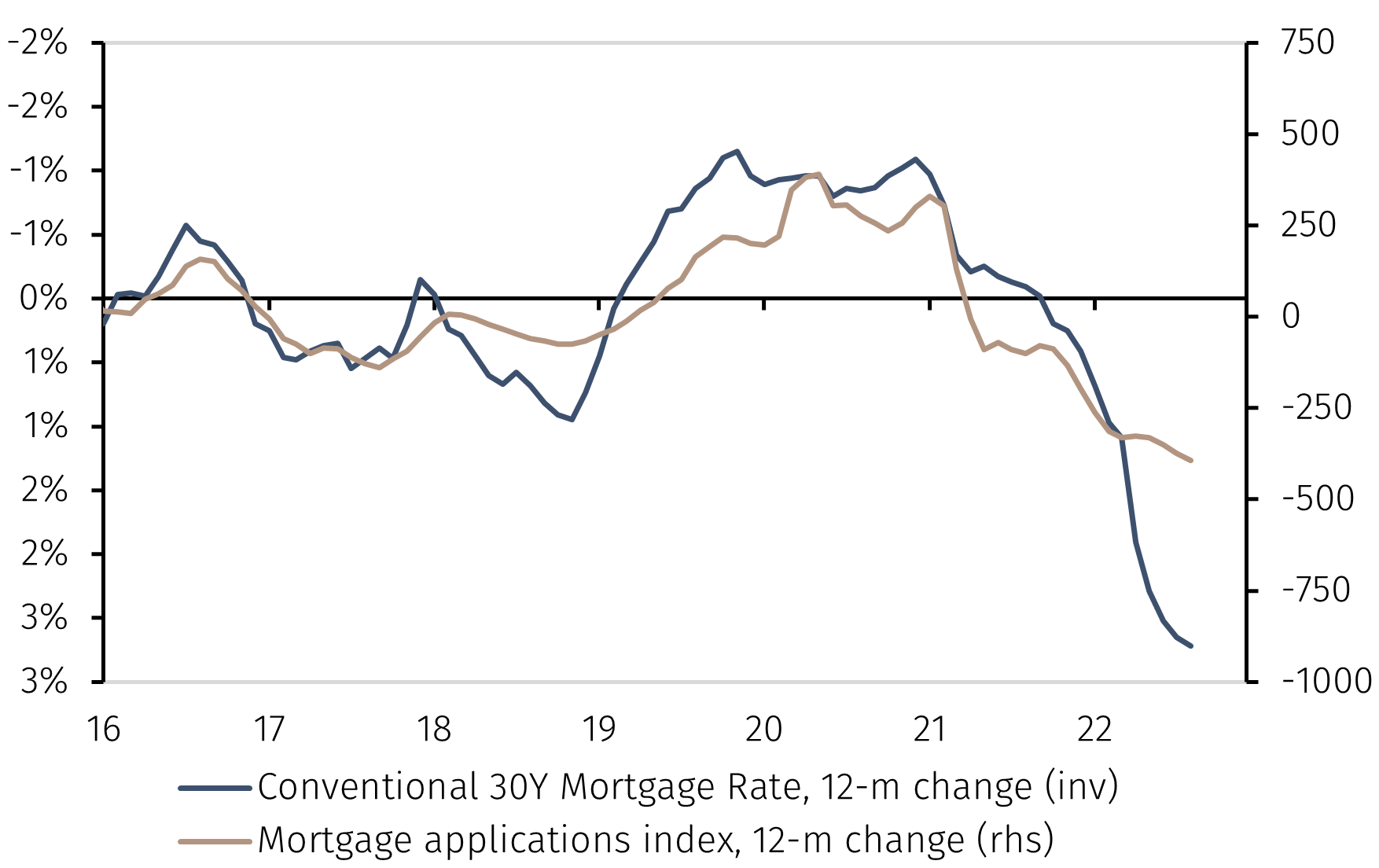

Another factor to highlight is the underlying rebalancing of the US housing market. The CPI for housing-related expenditures reflects the change in prices of real estate transactions with a lag of about 12 months. As a result of the monetary tightening in early 2022, mortgage rates have returned to 2007 levels, dampening demand for new mortgages. Meanwhile, the loosening of supply chains bottlenecks will help increase the completion of new houses. The rebalancing of supply and demand in the real estate market will cool house prices. If the moderation in house prices and rents that has emerged in recent months is confirmed, housing-related inflation will be lower in 2023 and with it the core inflation rate, of which housing represents around 45%.

Chart 4. Mortgage rates and applications

Source: Refinitiv and EFGAM calculations. Data as at 14 July 2022.

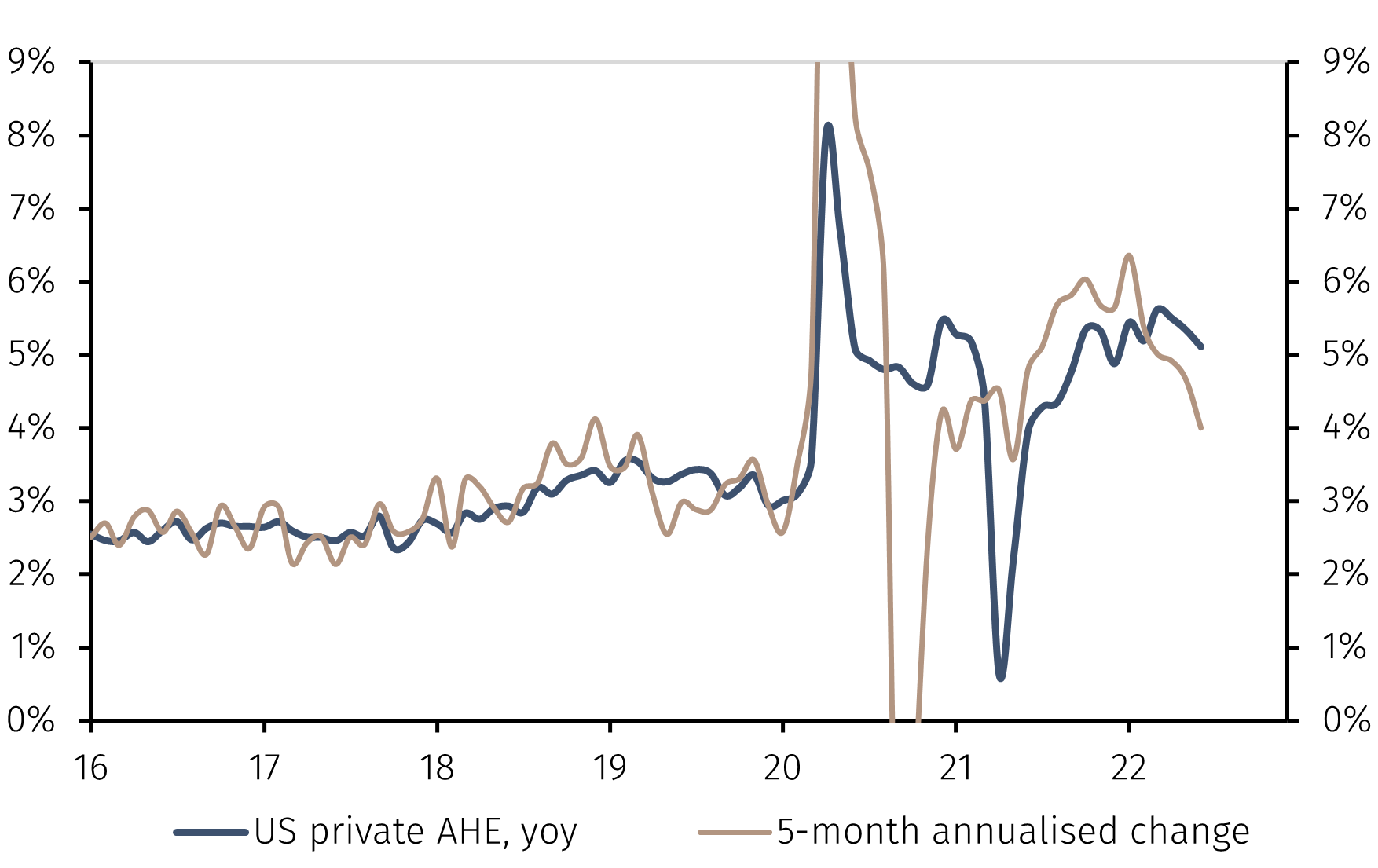

Finally, the June job market report confirmed the slowdown in wage inflation. The monthly increase of private sector average hourly earnings eased to 0.3% mom, pushing the annualised change over the last five months to less than 4%, much lower than the June year-on-year change of 5.1%. Again, if the trend is confirmed in the coming months, concerns about a possible price-wage spiral will subside.

Chart 5. US private average hourly earnings

Source: Refinitiv and EFGAM calculations. Data as at 14 July 2022.

In conclusion, although June CPI inflation was significantly higher than expected, several elements suggest that upstream pressures on consumer prices have recently moderated. While it seems a foregone conclusion that the Federal Reserve will raise the fed funds rates by at least 75 basis points at its July meeting, the chances have risen that the pace of rate increases in the latter part of the year will moderate.