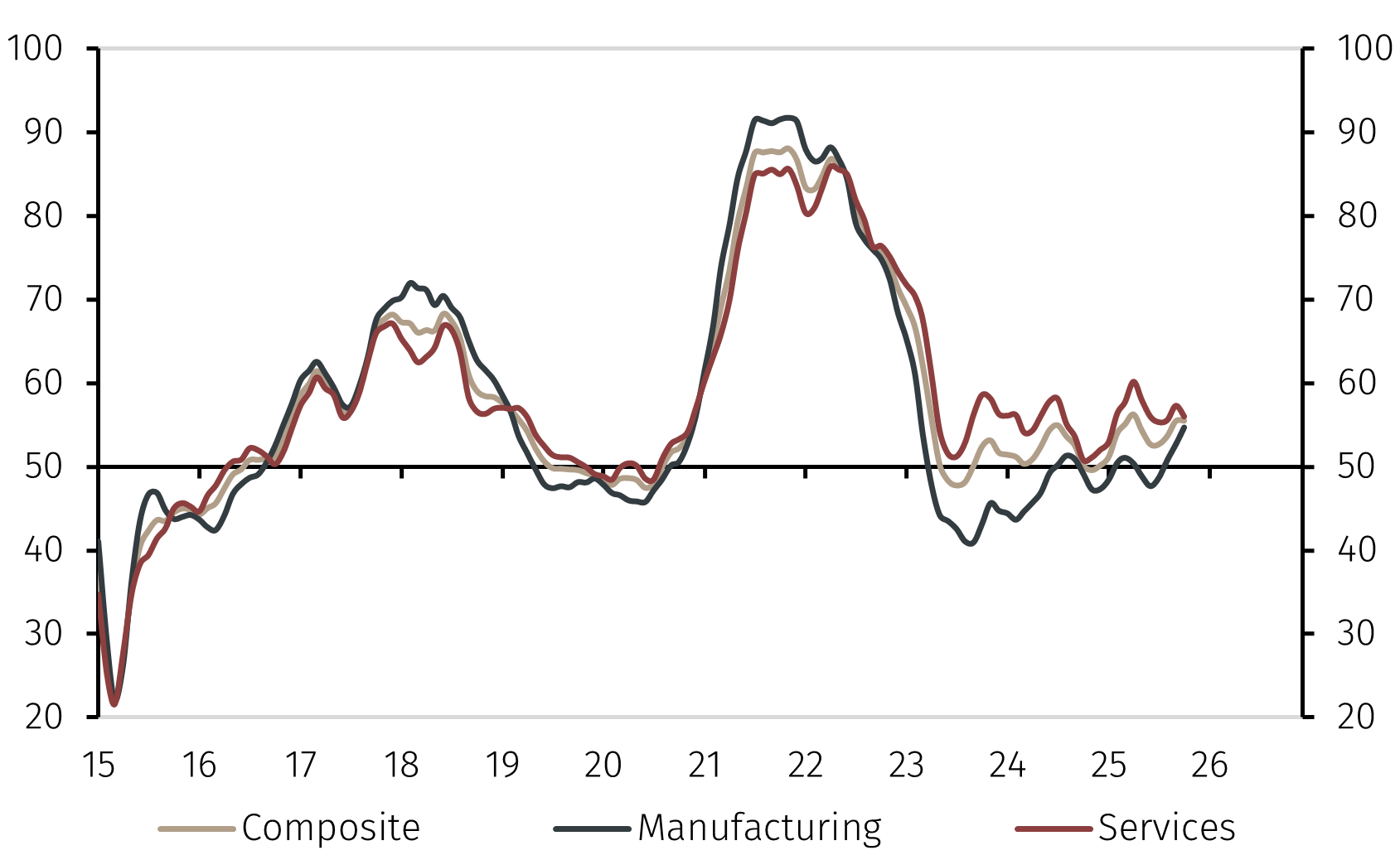

Additionally, fiscal stimulus in the eurozone, driven by Germany, may offer an offset to US tariffs. With a focus on infrastructure, defence, and the energy transition, it is expected to benefit also the Swiss economy. Overall, Swiss GDP growth will likely remain close to its potential rate of 1.5% in 2025-26.

Monetary policy outlook

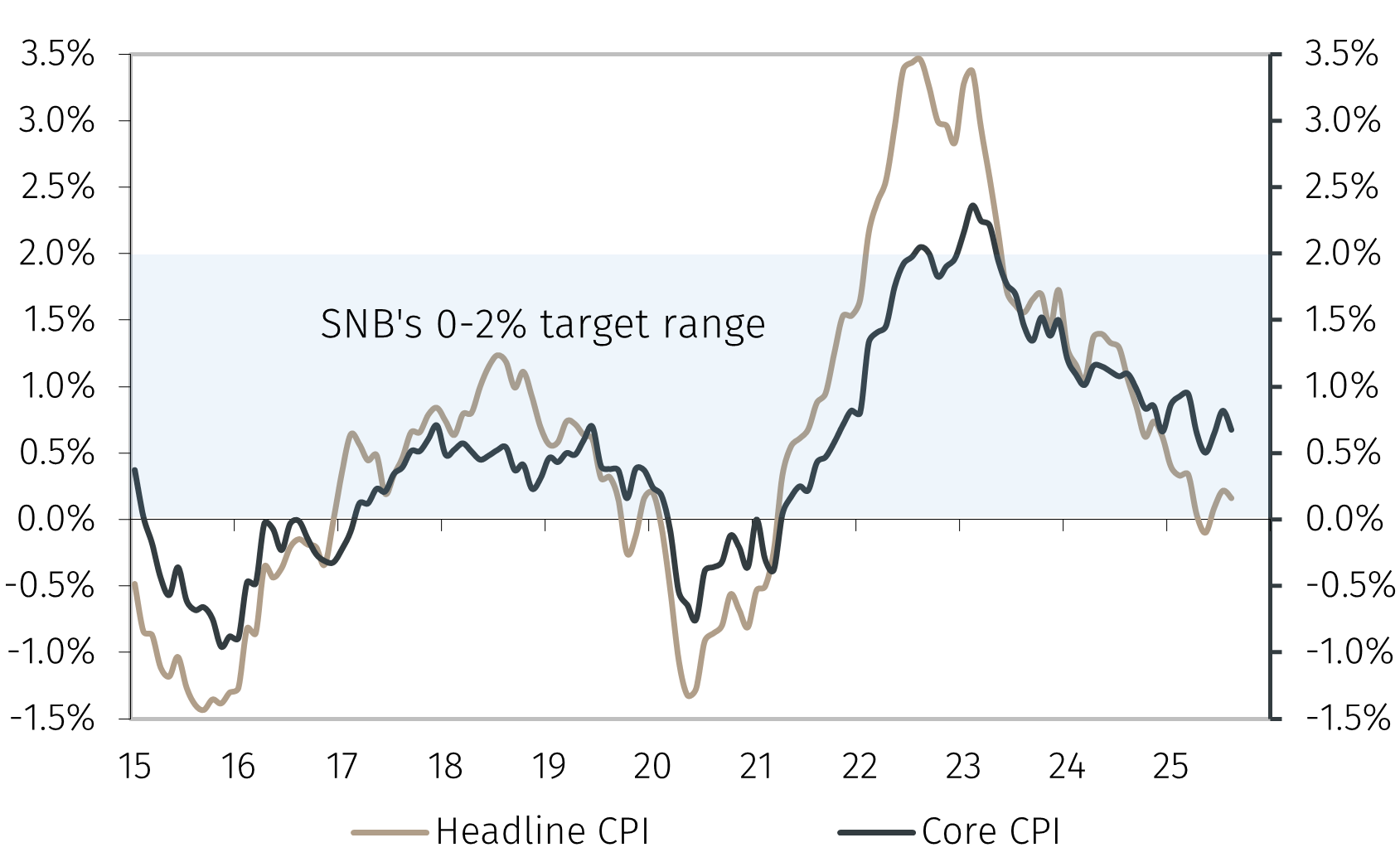

President Schlegel has emphasised that the objective of monetary policy is price stability "in the medium term". Therefore, even if downside risks to the economy materialise, deviations in inflation outside the 0-2% target range can be tolerated by the central bank if they are deemed to be temporary. Schlegel's comments signal that the bar for further cuts to the policy rate below 0% is high.

In early September, Schlegel also announced that, starting this quarter, the SNB will publish with a four-week delay a summary of the monetary policy meeting. The aim is to increase transparency and to help markets and the public better understand the Bank’s actions.

This initiative brings the SNB closer to the practice of other major central banks. It remains to be seen how much detail will be provided regarding alternative scenarios and forecasts, and the internal debate surrounding them. Noting that Schlegel has said that the Governing Board takes decisions collectively and jointly supports them afterwards there is a risk that the summary will give little insight into the SNB’s future monetary policy.