Sanae Takaichi, nicknamed the ‘Iron Lady’ after her inspiration, former British Prime Minister Margaret Thatcher, won the Liberal Democratic Party (LDP) leadership election on 4 October. With the LDP holding the most seats in the National Diet, Takaichi is set to be confirmed as Japan’s first female Prime Minister on 15 October.

Takaichi’s win came as a shock, with the ‘Iron Lady’ beating the frontrunner in the polls, Shinjiro Koizumi, in a runoff vote after no candidate secured enough votes for victory in the initial voting.1

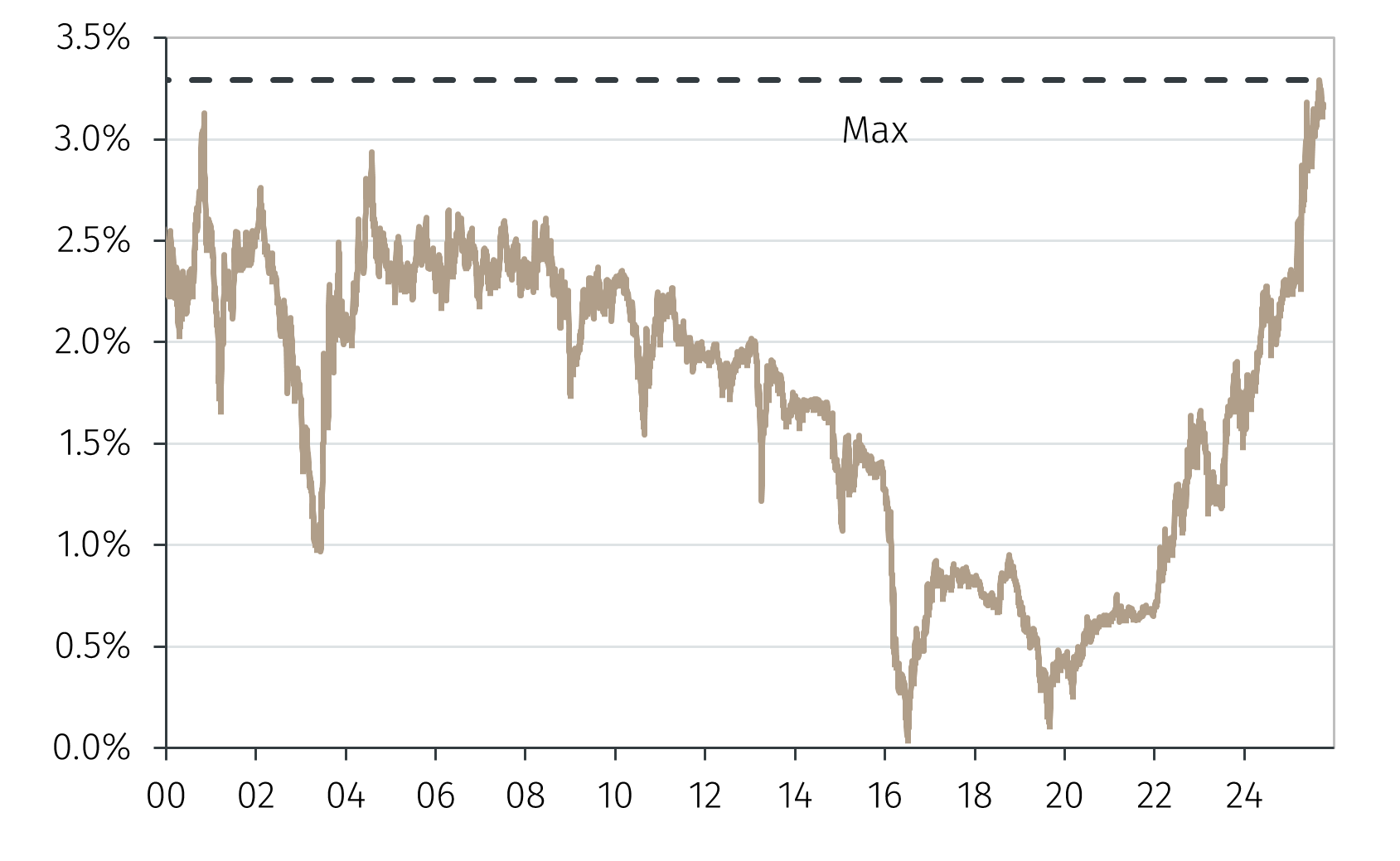

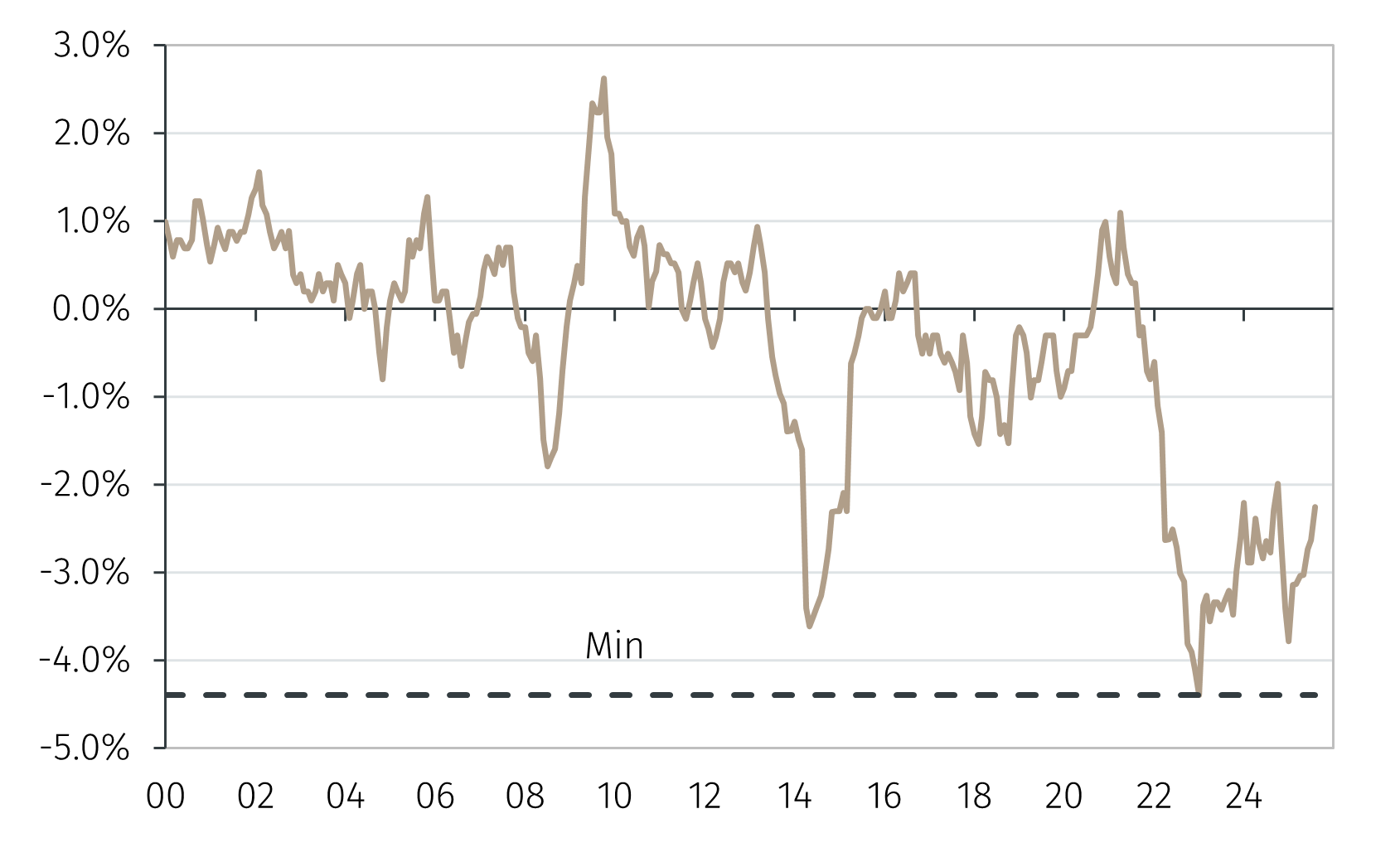

The ‘Iron Lady’ nickname is where the similarities between Thatcher and Takaichi end. While Thatcher’s government is remembered for its fiscal discipline, Takaichi is a protégé of former Prime Minister Abe and is an ‘Abenomics’ advocate.2 As such, she is expected to seek a more expansive fiscal policy to support gross domestic product growth in Japan. This is a policy which could put pressure on the long end of the Japanese government bond (JGB) curve, with the yield on the 30-year JGB already hovering around all-time highs due to fears over a lack of fiscal discipline (see Chart 1).