A rebalance, not negative prices

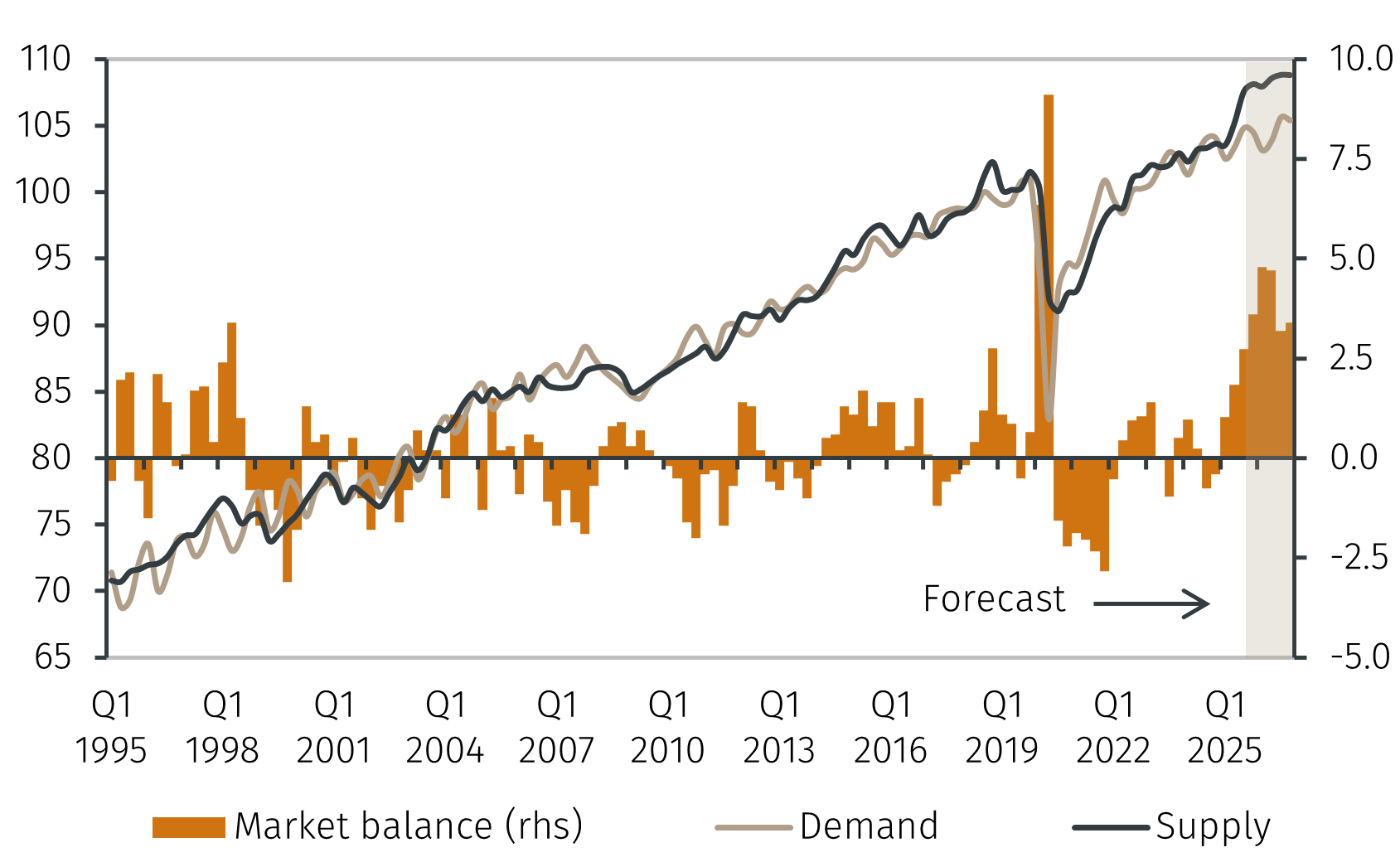

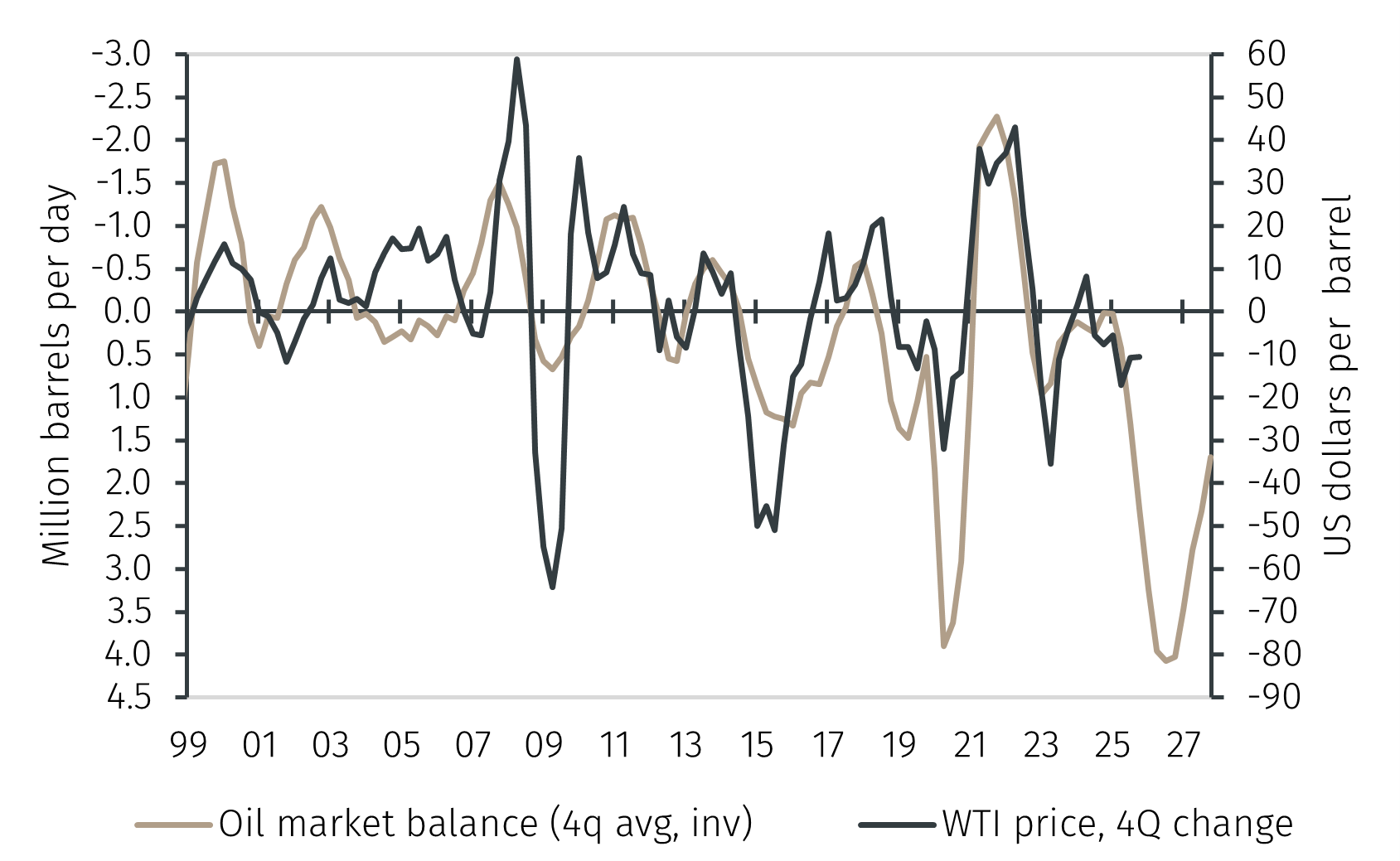

That very episode, however, suggests that the IEA's scenario would be unsustainable and, therefore, is unlikely to materialise. A more likely scenario is that endogenous oil market rebalancing mechanisms will operate in the coming quarters, reducing the gap between oil supply and demand. A first indication is perhaps the OPEC+ decision to suspend planned supply increases in the first three months of 2026.3 However, given the size of the oil supply and demand imbalance, a much larger adjustment is needed. But, for this to happen, a period of low prices, perhaps around or below USD 40 per barrel, will likely be needed. Notably, the WTI crude oil futures contracts anticipate its price will trade slightly above USD 60 pb until the end of 2026.

At that price level, several oil production sites, including US shale oil and deepwater extraction, would become uneconomic, reducing oil supply. Furthermore, the decline in refined product prices would stimulate demand, helping to close the supply glut. This, ultimately, will favour a gradual return of prices to more sustainable levels for marginal suppliers, including the US shale oil companies that continue to indicate a breakeven point above USD 60 pb.4

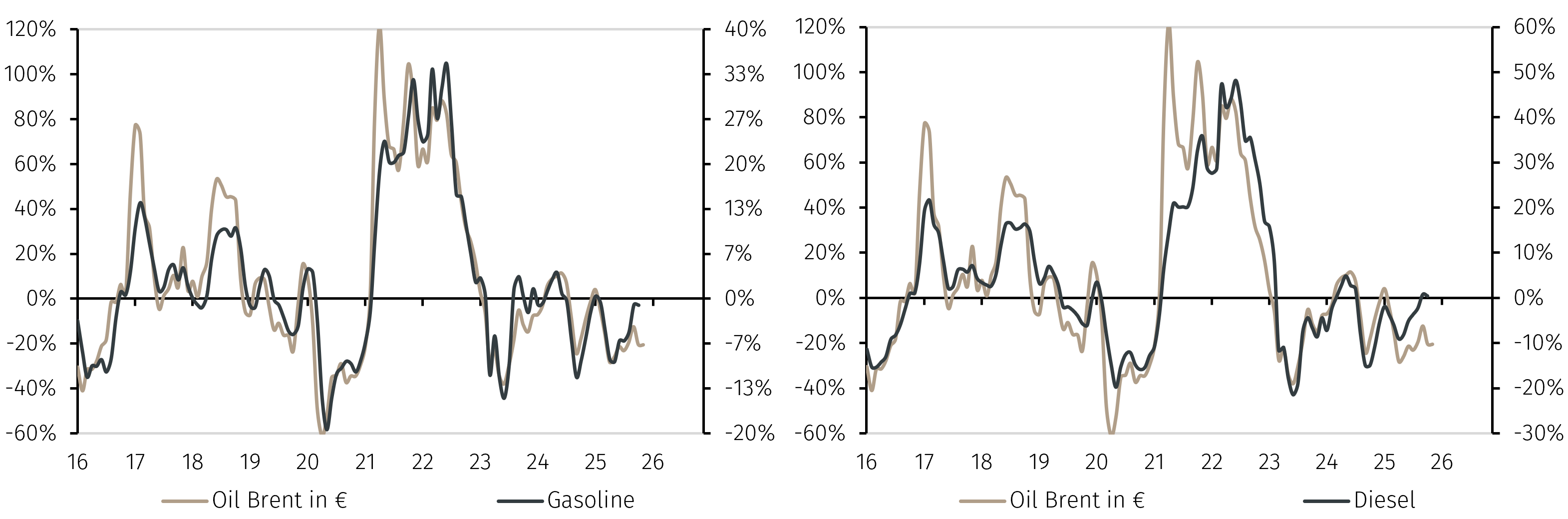

A prolonged period of lower crude oil prices than today will eventually allow consumers to benefit from lower energy bills. Indeed, due to reduced refining capacity following the Ukrainian attacks on Russian infrastructure, the supply of refined products has decreased. Because of increased refining margins, in the US, US gasoline prices have fallen less than 2% and diesel prices have risen by 4% since the beginning of the year, although crude oil prices fell by about 20% in due course. A similar trend is also observed in Europe, where a significant gap has opened up between the annual change in oil prices, expressed in euros, and those of refined products (see Charts 4 a and b).