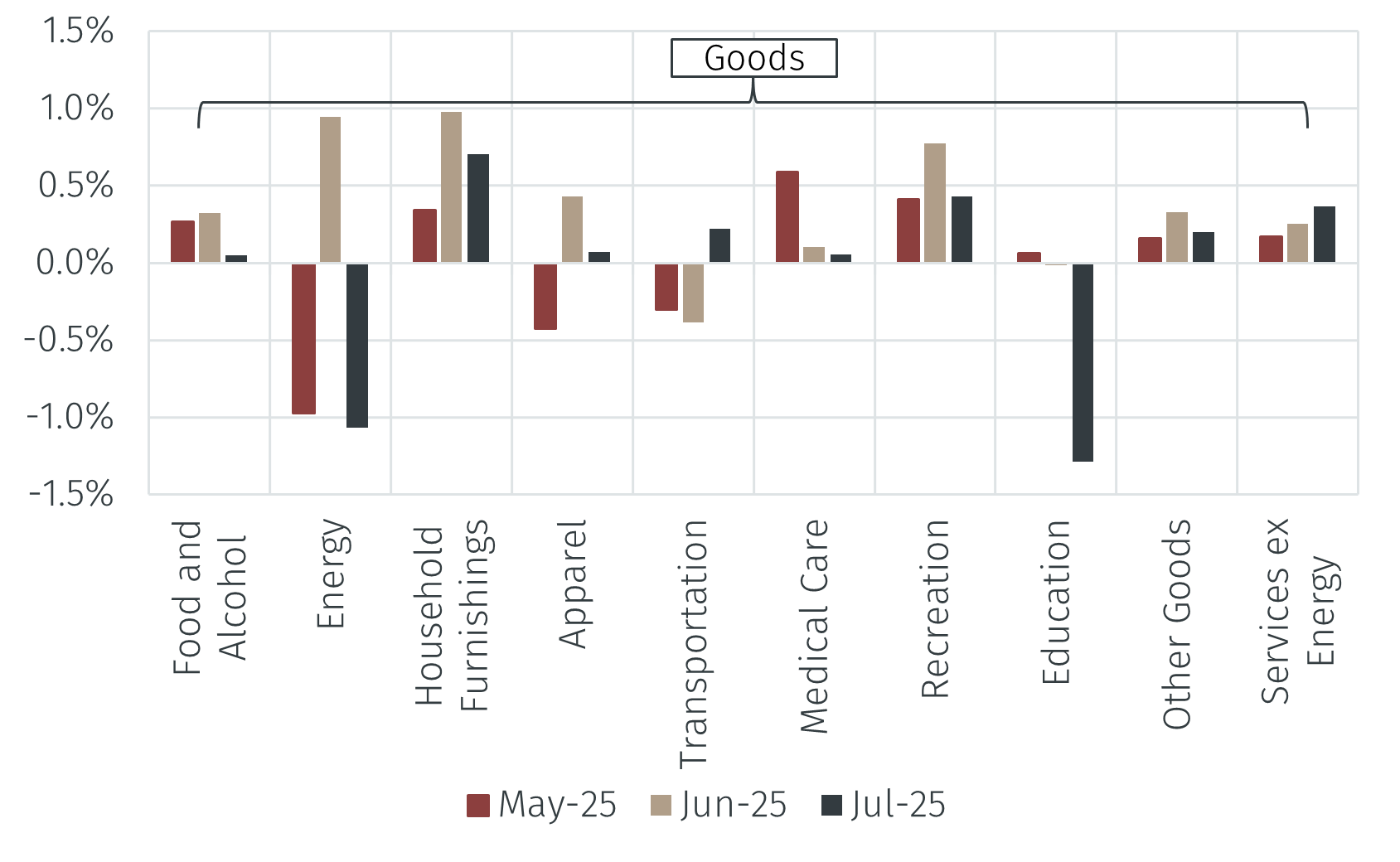

The recent US CPI release was in-line with expectations, delivering a monthly increase in the CPI of 0.2% and a year-over-year (YoY) change of 2.7%, the same as the previous month. The core index, which excludes food and energy, increased by 0.3% in July and by 3.1% over the past year, up from 2.9% in June. The positive equity market reaction was in part driven by the belief that this release solidifies the likelihood that the Federal Reserve will cut rates in September. Was that reasonable?

Sub-components

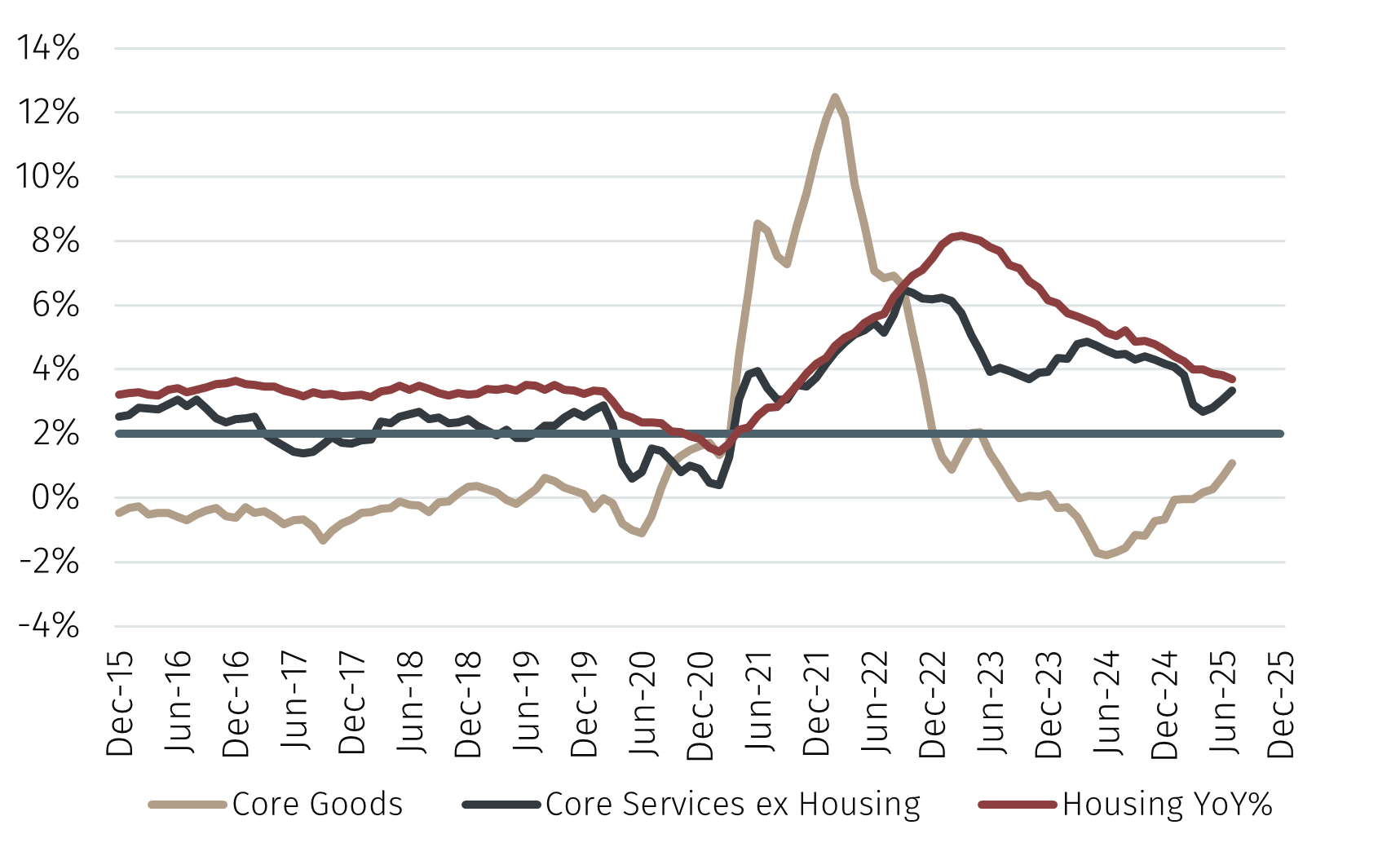

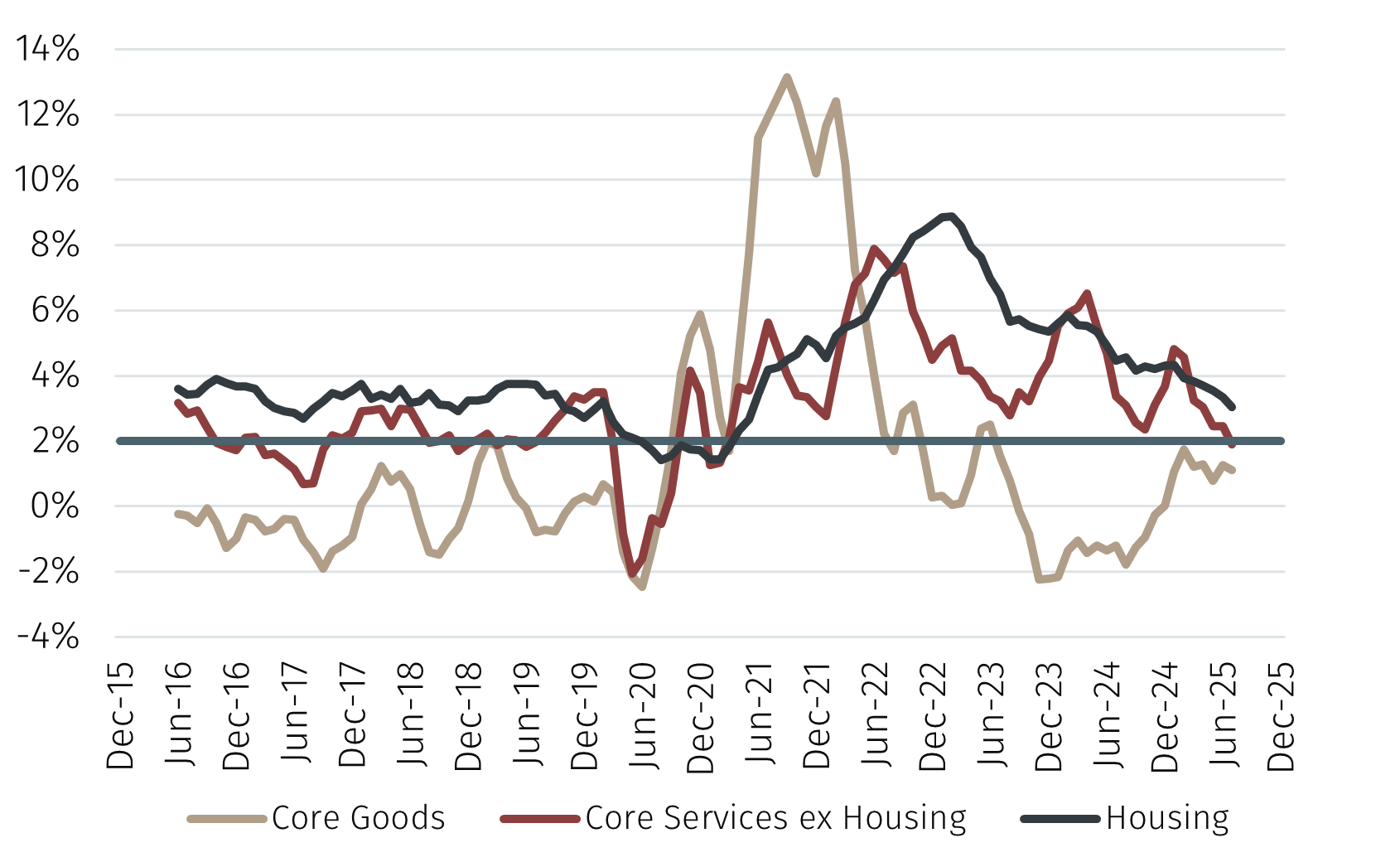

Looking at the sub-components of the CPI shows that core services ex-housing inflation increased from 3.0% year-over-year in June to 3.2% in July. This was offset by a slight decrease in housing inflation from 3.8% year-over-year last month to 3.7% in July.